![13 Lingerie Market Facts [Quick Overview]](https://wp.bedbible.com/wp-content/uploads/2024/03/Lingerie-Market.png)

Discover the Lingerie Industry’s Intriguing World with Bedbible.com’s Insightful Article. Explore the intersection of fashion and data as we uncover surprising trends, market insights, and the significant role of social media in lingerie shopping. This compelling article sheds light on the industry’s robust growth, emphasizing the impact of inclusivity and body positivity.

Embark on an enlightening exploration of the lingerie market, designed to provide a concise yet comprehensive overview. Drawing from extensive reports, our article distills key information about the global and US lingerie markets into a 5-minute read, ensuring you grasp the essentials quickly and effectively

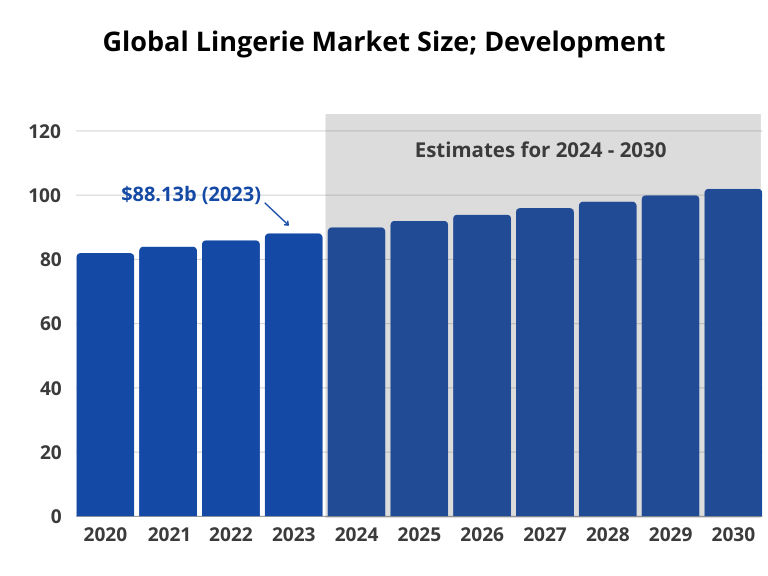

#1 – The global market size of lingerie is $88.13 billion (2023)

The lingerie industry had a total market size of $88.13 billion in 2023 and is expected to hit $131.99 billion in 2028.

#2 – The lingerie industry grows by almost 10% each year (CAGR)

The lingerie industry has grown on average +9.4% each year in the last 10 years. Compared to the women’s apparel market which grows on average 4.1% it is becoming a larger and larger part of the total industry.

#3 – 17% of the women’s apparel sold are lingerie

The lingerie industry makes up 17% of the women’s apparel market. And as the lingerie industry is growing faster than the women’s apparel market it is expected to be more than 1/5 of the market before 2025.

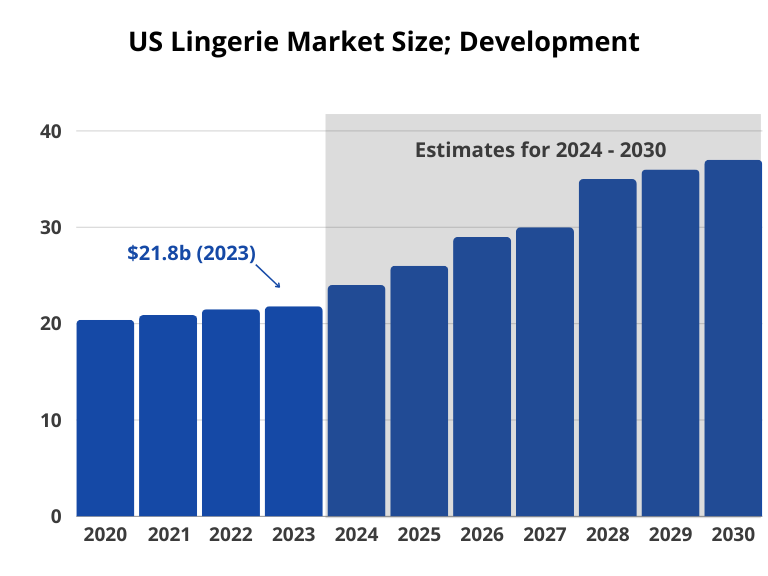

#4 – US accounts for 24.7% of the lingerie market

In 2023 the US accounted for 24.7% of the lingerie market ($21.8 billion) and was the second largest market after China. Following the US on the list is India, which only accounts for 6% of the total market in lingerie sales.

#5 – Bras account for 55.5% of the lingerie industry

Bras are the leading product category, accounting for 55.5% of the market.

#6 – The lingerie industry is 9 times larger than men’s underwear

In the lingerie industry, 9 times more revenue is generated compared to in the industry for men’s underwear. In addition, all men’s wear sold only amounts to under twice (1.7 times) the market for women’s lingerie.

#7 – Victoria’s Secret is the world’s largest lingerie company with $11.4 billion in sales annually

On the top 14 over the world are the following lingerie brands and the according revenue stream for the parent company that is also in the lingerie vertical:

| Rank | Company | Revenue |

|---|---|---|

| 1 | Victoria’s Secret | $11.4 billion |

| 2 | Zivame | $12.2 million |

| 3 | Gap | $16.6 billion |

| 4 | Amante, MAS Brands | $2.3 billion |

| 5 | Bare Necessities | $156 million |

| 6 | Calvin Klein | $6.3 billion |

| 7 | Triumph | $1.5 billion |

| 8 | Marks & Spencer | $11,8 billion |

| 9 | Jockey | $443.2 million |

| 10 | Lily of France | $621 million |

| 11 | Ralph Lauren | $6.2 billion |

| 12 | Natori | $200 million |

| 13 | Maidenform | $630 million |

| 14 | Spanx | $400 million |

Noticeably there are some big companies in between, however most in the “billion” dollar category are also in other verticals, and not only focused on lingerie as Victoria’s Secret. Maybe a strict focus on that niche has made them the force they are today.

#8 – 26.7% of lingerie purchases are made by men

Despite lingerie to a large extent catering to women 26.7% of all lingerie purchases online are made by men. Records of brick-and-mortar stores do not exist.

#9 – 7 out of 10 of all lingerie purchase decisions are affected by Instagram

Most lingerie purchases are affected by multiple channels – both social as well as classic TV or display commercials. However, very few purchase decisions are affected in some way by Instagram. Only 7.4% of lingerie customers have not been affected by Instagram.

#10 – Bra sizes are largest in the UK and smallest in Japan

On average bra sizes in the UK are a C-cup, while in Japan the average bra size is an AA-cup.

#11 – 5 out of the 10 biggest companies that provide fabrics to the lingerie industry are from China

- Best Pacific (China)

- Sun Hing Industries Holding (China)

- Lauma Fabrics (Latvia)

- Hongda Textile (China)

- Liebaert (Belgium)

- Marand (Iran)

- Nextil Group (Spain)

- Sanko Textiles (Turkey)

- Zhejiang Huachang Textile (China)

- Huading (China)

#12 – Only 2% of all lingerie is produced in European countries (6.5 billion)

More specifically 26 of 44 European countries even produce lingerie, and of the 26 only $6.5 billion worth of lingerie is produced.

| # | 26 Countries | Million dollars | Last available data | YoY | 5‑years CAGR |

|---|---|---|---|---|---|

| 1 | France | 1,727.80 | 2019 | -10.3 % | +6.8 % |

| 2 | Italy | 1,356.50 | 2019 | -1.2 % | -4.4 % |

| 3 | Germany | 845.90 | 2019 | +1.6 % | -3.2 % |

| 4 | Portugal | 353.10 | 2019 | -4.2 % | +0.3 % |

| 5 | Bulgaria | 298.30 | 2019 | +0.8 % | -1.9 % |

| 6 | Romania | 280.90 | 2019 | -1.2 % | -3.1 % |

| 7 | Spain | 208.50 | 2019 | +8.4 % | -3.6 % |

| 8 | Poland | 197.60 | 2019 | -6.6 % | +4.4 % |

| 9 | Sweden | 131.50 | 2019 | +2.4 % | +6.2 % |

| 10 | Austria | 126.20 | 2019 | -12.0 % | -11.3 % |

| 11 | Czech Republic | 108.50 | 2018 | +1.1 % | +6.3 % |

| 12 | Greece | 107.10 | 2019 | -8.6 % | -6.8 % |

| 13 | Lithuania | 96.40 | 2019 | -2.3 % | +4.5 % |

| 14 | United Kingdom | 86.00 | 2019 | -3.5 % | -8.2 % |

| 15 | Croatia | 72.00 | 2019 | -7.0 % | +5.0 % |

| 16 | Denmark | 70.80 | 2016 | +5.0 % | +3.3 % |

| 17 | Hungary | 66.20 | 2019 | -3.2 % | -3.2 % |

| 18 | Serbia | 63.40 | 2018 | -5.0 % | N/A |

| 19 | Slovakia | 58.70 | 2019 | +0.5 % | +4.2 % |

| 20 | Bosnia and Herzegovina | 46.30 | 2019 | +1.1 % | +26.0 % |

| 21 | Latvia | 36.90 | 2019 | -8.2 % | -3.9 % |

| 22 | Estonia | 31.30 | 2017 | +2.6 % | +12.7% |

| 23 | Macedonia | 11.80 | 2018 | -3.3 % | -9.4 % |

| 24 | Finland | 2.90 | 2019 | -45.3 % | -42.8 % |

| 25 | Cyprus | 1.00 | 2019 | -16.7 % | -9.0 % |

| 26 | Malta | 0.00 | 2018 | N/A | N/A |

#13 – 7 fun facts about lingerie

- The word ‘lingerie’ in French applies to both women’s and men’s undergarments.

- in the 1900s it was popular to use bras in a way that made it look like you had a “monoboob”.

- 7% of women prefer not to wear any underwear at all.

- The average lifespan of a bra is 6 months.

- Triumph was the first company to show lingerie on the catwalk.

- In Italy wearing red underwear on New Year’s Eve is believed to bring good luck.

- More and more people are buying BDSM lingerie.

Sources: Grandviewresearch.com, Mordorintelligence.com and Marketresearchfuture.com