![Plus Size Industry [Facts, Figures & Numbers]](https://wp.bedbible.com/wp-content/uploads/2024/06/Plus-Size-Industry-Facts-Figures-Numbers.png)

Curious about the booming plus-size fashion scene? This report dives deep into statistics that will surprise you. We’ll explore the market’s massive size, along with insights into what sizes are most popular for women. Is the average American body type changing? We’ll explore that too. Beyond the numbers, we’ll uncover the biggest players in the industry and provide helpful definitions to navigate sizing conversions with ease.

Dive in and discover the power of the plus-size market!

Here’s what you can find in this report:

- Market Size

- Sizing Demographic of Women – what sizes are used most?

- The Average Size American Man and Woman

- Facts

- Biggest Plus Size Brands

- Definitions

Key Takeaways

- The market size for plus size clothing is $31.1bn in the US (2023), growing by +6% YoY.

- The market for plus size clothing is expected to reach over $50bn by 2023 in the US, and $912bn worldwide.

- The average dress size in the US is size 16, making plus size the norm in 2023.

- 67% of American women use a size 14 or above.

- The plus size clothing market grows x3 faster (+6% annually) than the overall clothing market which grows at +2% a year.

- 114 million American women are considered “plus size” by the fashion industry today.

- Only 23% of clothes bought today in the US are considered to be standard/average sizes.

Market Size

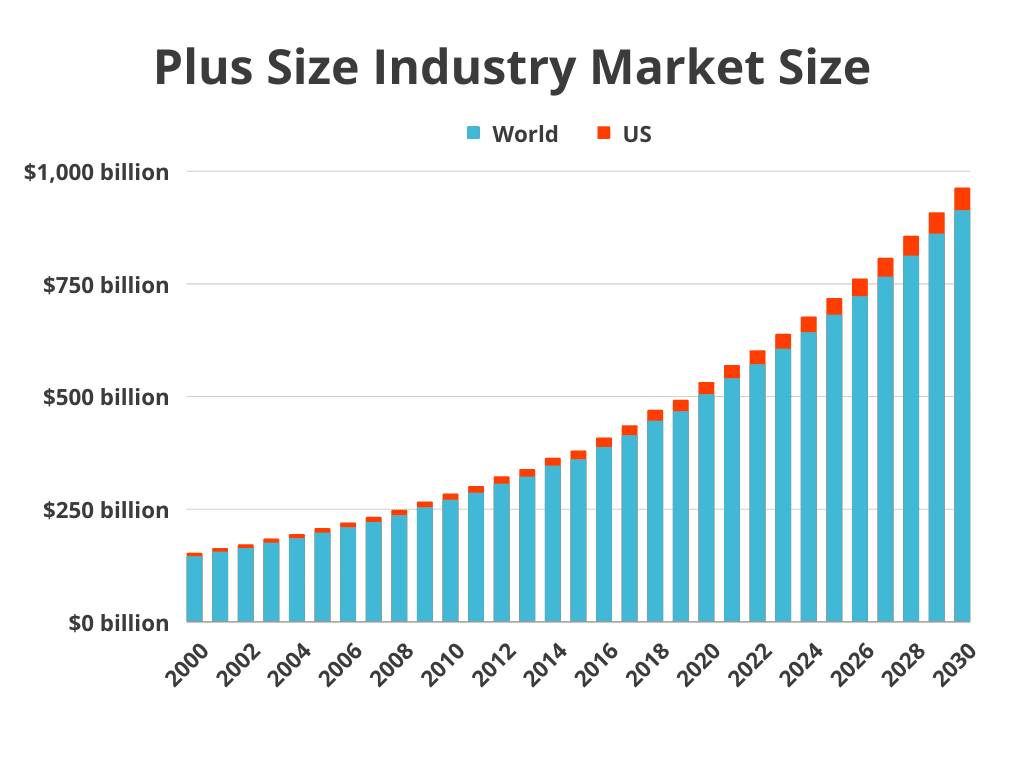

The market for plus size clothing has seen tremendous growth of more than 6% each year.

The yearly growth rate typically varies from 4-8% on any given year, which due to the relatively large market isn’t visible in the numerical data nor graphs as seen below.

A correlation we noticed after analyzing the data is that the Plus Size Industry growth rates follow the Global GDP growth rates. The Average global GDP growth is 5.8% making it very closely related to the plus size industry.

| Year | US | US, CAGR | World | World, CAGR |

|---|---|---|---|---|

| 2000 | $7.4bn | 5.31% | $143.67bn | 5.59% |

| 2001 | $7.94bn | 7.11% | $153.97bn | 6.69% |

| 2002 | $8.35bn | 5.17% | $161.76bn | 4.82% |

| 2003 | $8.99bn | 6.65% | $173.98bn | 7.02% |

| 2004 | $9.49bn | 5.62% | $183.35bn | 5.11% |

| 2005 | $10.02bn | 5.51% | $196.25bn | 6.57% |

| 2006 | $10.65bn | 6.35% | $207.78bn | 5.55% |

| 2007 | $11.41bn | 7.11% | $219.74bn | 5.44% |

| 2008 | $12.12bn | 6.27% | $234.44bn | 6.27% |

| 2009 | $12.93bn | 5.66% | $252.15bn | 7.03% |

| 2010 | $13.81bn | 6.77% | $268.8bn | 6.19% |

| 2011 | $14.76bn | 4.88% | $284.73bn | 5.59% |

| 2012 | $15.79bn | 6.99% | $305.14bn | 6.69% |

| 2013 | $16.91bn | 4.10% | $320.59bn | 4.82% |

| 2014 | $18.13bn | 7.20% | $344.36bn | 6.90% |

| 2015 | $19.45bn | 6.31% | $358.88bn | 4.05% |

| 2016 | $20.9bn | 7.42% | $386.38bn | 7.12% |

| 2017 | $22.47bn | 4.53% | $412.08bn | 6.24% |

| 2018 | $24.19bn | 7.64% | $444.68bn | 7.33% |

| 2019 | $25.79bn | 6.60% | $465.52bn | 4.48% |

| 2020 | $27.23bn | 5.58% | $503.53bn | 7.55% |

| 2021 | $29.4bn | 7.97% | $538.66bn | 6.52% |

| 2022 | $31.1bn | 5.79% | $570.1bn | 5.52% |

| 2023 | $33.03bn | 6.20% | $604.59bn | 6.05% |

| 2024 | $35.08bn | 6.20% | $641.17bn | 6.05% |

| 2025 | $37.25bn | 6.20% | $679.96bn | 6.05% |

| 2026 | $39.56bn | 6.20% | $721.1bn | 6.05% |

| 2027 | $42.01bn | 6.20% | $764.72bn | 6.05% |

| 2028 | $44.62bn | 6.20% | $810.99bn | 6.05% |

| 2029 | $47.38bn | 6.20% | $860.05bn | 6.05% |

| 2030 | $50.32bn | 6.20% | $912.09bn | 6.05% |

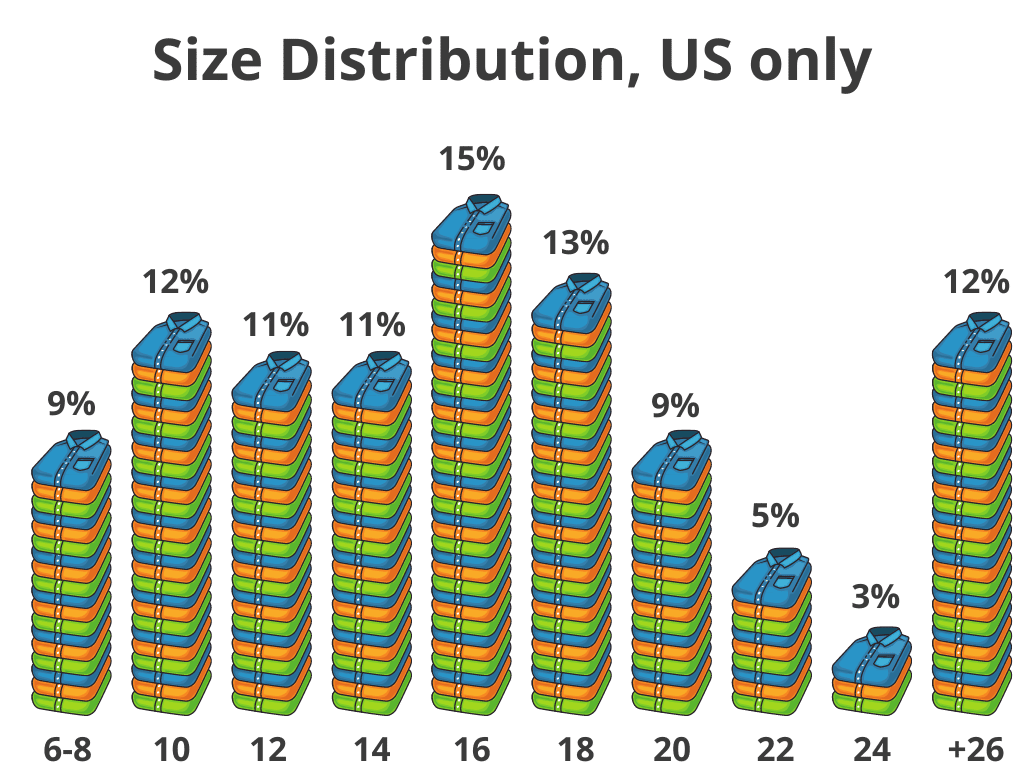

Sizing Demographic of Women – what sizes are used most?

We used the dress sizes from 6-34 as an indicator of the distribution of all plus size clothes.

the most interesting finding was that aggregating all sizes that would be considered plus size (14 and over) it amounts to 68% of all US women

| Size | Percentage of American Women |

|---|---|

| 6 | 3% |

| 8 | 6% |

| 10 | 12% |

| 12 | 11% |

| 14 | 11% |

| 16 | 15% |

| 18 | 13% |

| 20 | 9% |

| 22 | 5% |

| 24 | 3% |

| 26 | 4% |

| 28 | 3% |

| 30 | 1% |

| 32 | 2% |

| 34 | 2% |

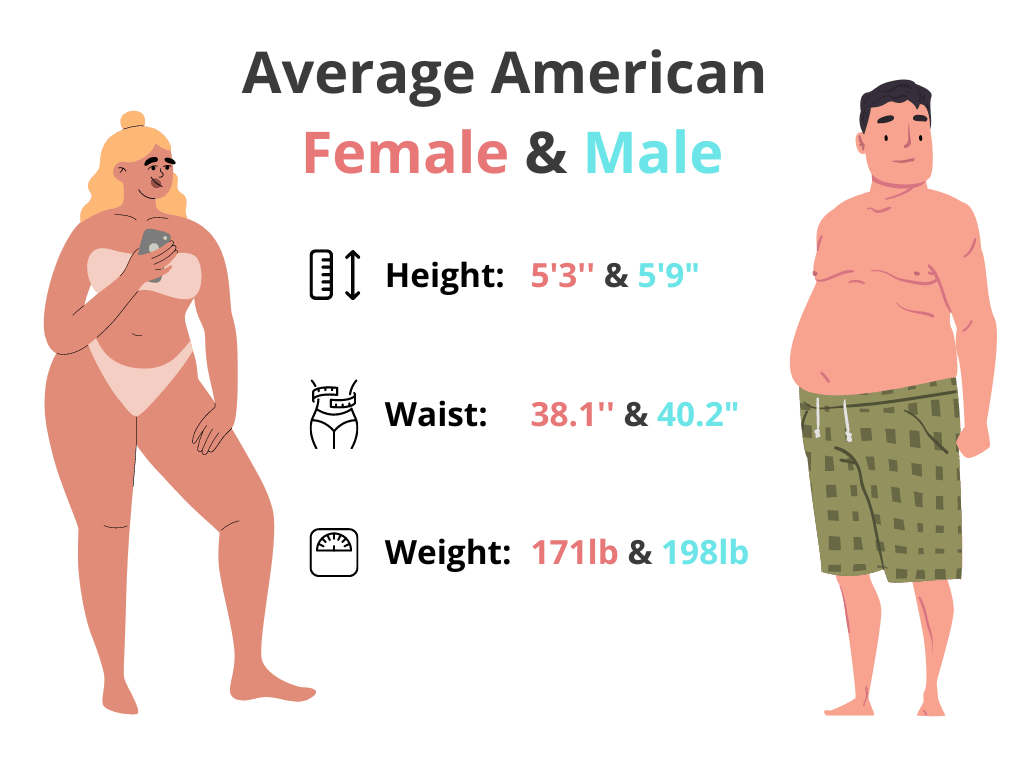

The Average Size American Man and Woman

Clothing sizes have changed drastically over the years. With a 1950’s size 16 being the equivalent of a size 8 today (in 2023). This is not only due to men and women growing taller and being bigger people, but also a perception.

Therefore to more accurately present data on clothing sizes, it’s important to hold it up against objective data on body sizes. Aggregating the data we’ve managed to find the average women and men of today’s America.

Facts

- The plus size market is still considered underrepresented and underserved in the fashion industry, with many individuals still facing difficulty in finding fashionable, well-fitting clothing in larger sizes.

- Online marketplaces and size-specific retailers have been filling the gap left by traditional retailers who have been slow to adapt.

- The term “plus size” is often considered controversial and out of date, as it implies that larger sizes are “extra” or “additional” and separate from the “normal” or “standard” sizes.

- The fashion industry has been criticized for not being inclusive and not accommodating the majority of the population, as plus size models represent less than 2% of models in the industry.

- Many plus size individuals are still facing discrimination, body shaming, and lack of representation in the media and advertising.

- There is a growing movement of plus size influencers, bloggers, and models who are promoting body positivity and challenging the traditional notions of beauty and fashion.

Biggest Plus Size Brands

Here are 11 different plus-size brands focusing exclusively on sizes +14:

- Lane Bryant: Founded in 1904, Lane Bryant is one of the oldest and most well-known plus-size clothing brands in the United States. They offer a wide range of clothing, including casual wear, activewear, and formal wear.

- Torrid: Torrid is a plus-size clothing brand that specializes in fashion-forward clothing for young women. They offer a wide range of clothing, including dresses, jeans, and lingerie.

- Eloquii: Eloquii is a plus size fashion brand that offers a wide range of clothing, including workwear, party dresses, and casual wear.

- Ashley Stewart: Ashley Stewart is a plus size clothing brand that offers a wide range of clothing, including dresses, jeans, and activewear.

- Simply Be: Simply Be is a plus size clothing brand that offers a wide range of clothing, including dresses, jeans, and activewear.

- Avenue: Avenue is a plus size clothing brand that offers a wide range of clothing, including dresses, jeans, and activewear.

- Fashion to Figure: Fashion to Figure is a plus size clothing brand that specializes in trendy clothing for plus-size women.

- Rebdolls: Rebdolls is a plus size fashion brand that specializes in trendy and fashionable clothing for plus-size women, including trendy tops, dresses, and activewear.

- Hips & Curves: Hips & Curves is a plus-size lingerie and intimate apparel brand that offers a wide range of products, including bras, panties, and sleepwear.

- Gwynnie Bee: Gwynnie Bee is a plus size clothing subscription service that offers a wide range of clothing, including dresses, jeans, and activewear.

- Adrianna Papell Plus: Adrianna Papell Plus is a plus size clothing brand that offers a wide range of clothing, including dresses, tops, and skirts.

- City Chic: City Chic is an Australian plus size clothing brand that offers a wide range of clothing, including dresses, tops, and jeans.

- Dia&Co: Dia&Co is a plus size clothing and styling service that offers a wide range of clothing, including dresses, tops, and jeans.

- SWAK Designs: SWAK Designs is a plus size clothing brand that specializes in fashionable clothing for plus-size women, including tops, dresses, and activewear.

- Kiyonna: Kiyonna is a plus size clothing brand that specializes in special occasion wear, such as wedding dresses and formal wear.

- Monif C: Monif C is a plus size clothing brand that specializes in fashionable clothing for plus-size women, including dresses, tops, and swimwear.

- Premme: Premme is a plus size clothing brand that specializes in trendy and fashionable clothing for plus-size women, including tops, dresses, and activewear.

- Curvy Sense: Curvy Sense is a plus size clothing brand that specializes in trendy clothing for plus-size women, including tops, dresses, and activewear.

- Modcloth: Modcloth is a plus size clothing brand that offers a wide range of clothing, including dresses, tops, and activewear.

Definitions

The definition of plus size can vary depending on the context and the source. In general, plus size refers to clothing and fashion items that are designed for individuals who wear larger sizes than what is considered “standard” or “average.”

In the fashion industry, plus size typically refers to clothing in sizes 14 and above, although some retailers may consider sizes 12 and above to be plus size. However, it’s worth noting that the definition of plus size can be influenced by cultural and societal factors, and there is no universally agreed-upon standard for what constitutes a plus size.

In general, plus-size clothing is designed and created to accommodate the needs of people with larger bodies, and it is not limited to a specific size, but rather it covers a range of sizes that are above average.

It’s also worth noting that the term “plus size” has been criticized by some, as it can imply that larger sizes are “extra” or “additional” and separate from the “normal” or “standard” sizes. Alternative terms such as “extended sizes” or “inclusive sizes” are sometimes used instead.