In the digital realm where hearts connect, romance scams have emerged as a growing peril. The Bedbible Research Center’s latest report, ‘Romance Scams Statistics,’ offers a succinct yet powerful examination of these scams’ increasing prevalence and their financial and emotional toll. Our analysis, rooted in data and real-life stories, aims to illuminate the hidden dangers in the pursuit of online romance, highlighting the urgent need for awareness and vigilance in our digital interactions

What is “Romance Scams”: Romance scams involve fraudsters using fake online profiles to trick victims into romantic relationships, primarily to steal money.

Here’s what you can find in this report:

- Romance scam cases and money lost over time

- Demographic: Median losses per age group

- Transferring methods

- Romance scams compared to other financial scams

- +36% of romance scams start on social media

- Fun Facts

Top Discoveries

- In 2023 there were 84,000 total reported cases of Romance Scams. Leading to losses of $980M for the American people.

- Elderly Most Affected Financially: Individuals aged 70 and above are most susceptible to suffering the highest financial losses per reported incident of a romance scam, highlighting the particular vulnerability of the elderly in these scams.

- Diverse Methods of Money Transfer: Cryptocurrency transfers and gift cards are among the most common methods used in romance scams, reflecting the scammers’ preference for untraceable and irreversible transactions.

- Romance Scams as a Major Contributor to Financial Fraud: Romance scams constitute a significant portion of all financial losses due to scams, making them one of the most impactful types of financial fraud.

- Social Media as a Primary Platform for Scams: Over 36% of romance scams originate on social media platforms, challenging the common belief that these scams are confined to dating services and platforms.

- Emotional Impact on Victims: Victims of romance scams often experience profound emotional distress, sometimes mourning the loss of the relationship more than the financial loss.

- Involvement in Money Laundering: A notable percentage of romance scams involve money laundering, with victims unknowingly used as ‘money mules.’

- High Proportion of Fake Dating Profiles: A significant number of dating profiles are estimated to be fake, underscoring the need for vigilance in online dating environments.

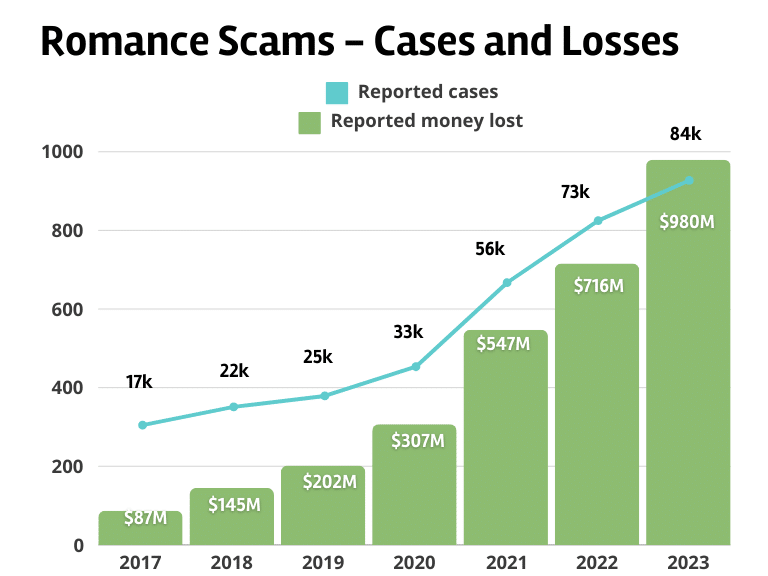

Romance scam cases and money lost over time

Consistent Yearly Increase: There has been a consistent increase in both the number of reported cases and the reported money lost due to romance scams each year. This trend indicates that romance scams are becoming more prevalent and more successful at deceiving victims.

Significant Jump in 2021: The year 2021 shows a particularly sharp increase, with a 69.7% rise in cases and a 78.2% increase in money lost compared to 2020. This could suggest either an increase in the number of scammers, their effectiveness, or possibly a greater awareness and reporting of these scams.

Increasing Financial Impact: The total reported money lost has more than tenfold increased from $87 million in 2017 to $980 million in 2023. This significant rise in financial impact highlights the growing sophistication and scale of romance scams.

Higher Average Annual Increase in Money Lost Than Cases: The average annual increase in money lost (50.6%) is higher than the increase in cases (31.7%). This disparity suggests that while the number of scams is growing, the amount of money each scam successfully extracts from victims is growing at an even faster rate, indicating potentially more sophisticated or high-stakes scams.

2023 Data Shows Continued Growth: In 2023, both the number of cases and the amount of money lost continued to grow, albeit at a slightly slower rate than in 2021. This continued growth indicates that romance scams remain a significant and evolving threat.

| Year | Reported cases | Reported money lost | % increase (cases) | % increase ($ amount) |

|---|---|---|---|---|

| 2017 | 17,000 | $87M | – | – |

| 2018 | 22,000 | $145M | +29.4% | +66.7% |

| 2019 | 25,000 | $202M | +13.6% | +39.3% |

| 2020 | 33,000 | $307M | +32.0% | +52.0% |

| 2021 | 56,000 | $547M | +69.7% | +78.2% |

| 2022 | 73,000 | $716M | +30.4% | +30.9% |

| 2023 | 84,000 | $980M | +15.1% | +36.8% |

| Total (7 years) | 310,000 | 2,984 | avg. +31,7% | avg. +50,6% |

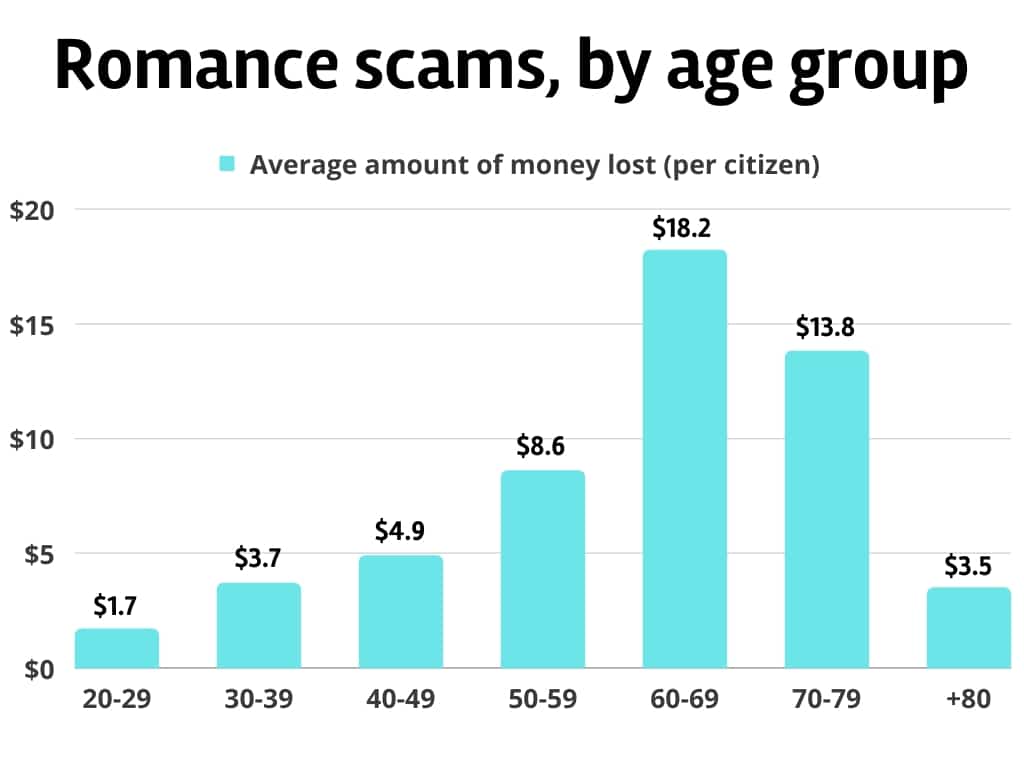

Demographic: Median losses per age group

Through our analysis, we found that especially 70+-year-olds were prone to lose the most amount of money per reported incident of a romance scam.

The data used to come to this conclusion can be found in the below table:

However, interestingly, if we use the data to instead look at how the total losses per age group would amount to average losses per individual in each individual in age group in the total population we instead find that 60-69-year-olds actually on average lose the most amount of money.

| Age group | Median money lost |

|---|---|

| 18-29 | $750 |

| 30-39 | $3,000 |

| 50-59 | $4,000 |

| 60-69 | $6,000 |

| 70+ | $9,000 |

Transferring methods

Based on the monetary amount transferred cryptocurrency transfers are one of the most used methods. However, most cases involve a transfer through gift cards or refillable credit cards. Most methods share the commonality that they help the scammers maintain anonymity.

| % of victims used the method | Total reported losses | % of victims used method |

|---|---|---|

| Cryptocurrency | $139M | 18% |

| Bank transfer/payment app | $121M | 27% |

| Wire transfer | $93M | 12% |

| Gift cards | $36M | 28% |

Romance scams compared to other financial scams

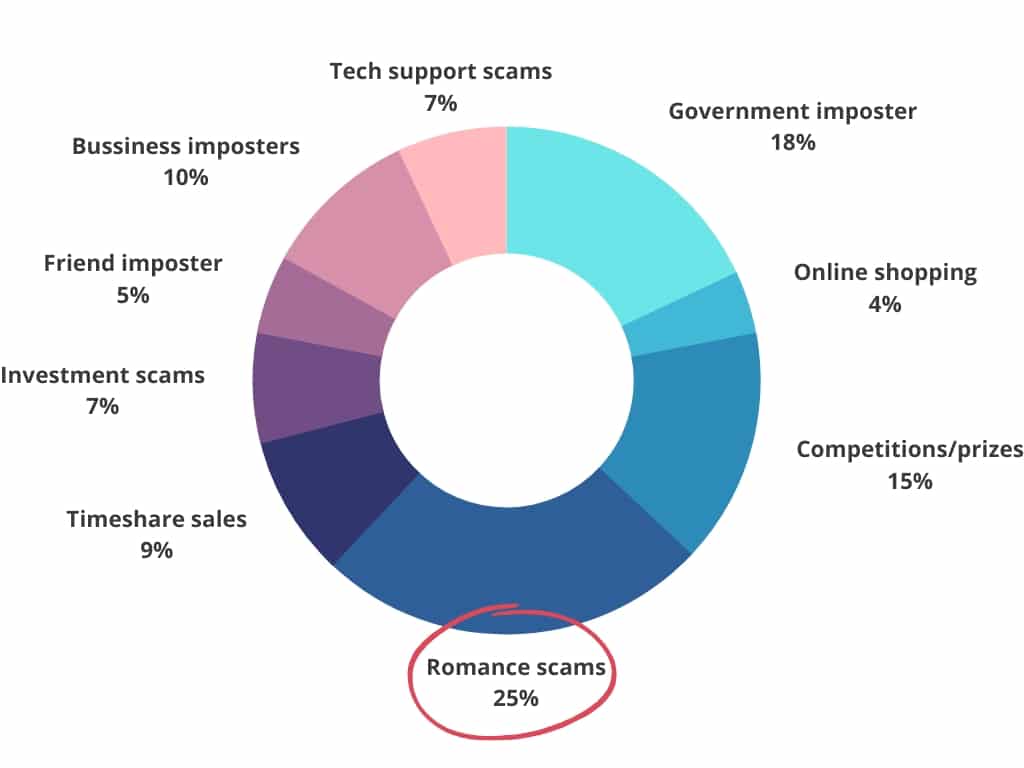

As a way to better understand the scale and impact of romance scams, we have compared it, in the below pie chart and table, to other types of financial scams reported to the FTC.

What the data showed is that 25% of all financial losses due to scams stem from romance-related scamming. Making romance scams the single biggest contributor to individual financial losses to scams.

| Fraud types | Amount lost | % of all frauds |

|---|---|---|

| Romance scams | $707.6 M | 24.7% |

| Government imposter | $513.8 M | 17.9% |

| Competitions/prizes | $429.6 M | 15.0% |

| Bussiness imposters | $286.4 M | 10.0% |

| Investment scams | $210.6 M | 7.4% |

| Tech support scams | $202.2 M | 7.1% |

| Timeshare sales | $143.2 M | 5.0% |

| Friend imposter | $143.2 M | 5.0% |

| Online shopping | $117.9 M | 4.1% |

| Timeshare Resales | $109.5 M | 3.8% |

| Total | $2,864 M | 100% |

+36% of romance scams start on social media

Despite general beliefs that romantic scams are directly related to online dating services, platforms, and apps we find in the data that more than 36% of romance scams happen on Facebook and Instagram:

- 52% of romance scams are reported to have happened on dating services and platforms.

- 23% of romance scams are reported to have happened on Facebook.

- 13% of romance scams are reported to have happened on Instagram.

- 12% of romance scams happen on other online forums.

- This means that Social Media accounts for more than 36% of the places where romance scams are perpetrated.

Fun Facts

- Victims often mourn the loss of the romantic relationship more than the financial loss.

- Romantic scams are often highly structured work of criminal groups.

- 52% of respondents answered that they feel more vulnerable to potential romantic scams on Valentine’s Day.

- Up to 30% of romantic scams involve laundering money, and victims are essentially used as ‘money mules’.

- It is estimated that 1 in 7 dating profiles are fake (find more online dating statistics here).