![Sex Tech Industry [Market Report & Statistics]](https://wp.bedbible.com/wp-content/uploads/2023/03/SexTech-Industry-Market-Report-Statistics.png)

Welcome to the exciting world of SexTech! In recent years, technological advancements have paved the way for a new industry that combines sexuality and technology. The sex tech industry has been rapidly growing, driven by a shift towards greater openness and acceptance of sexual diversity, as well as the increasing use of technology in all aspects of our lives.

So whether you’re an investor looking to capitalize on this emerging industry, a curious consumer interested in trying out the latest SexTech products, or simply someone interested in learning more about this rapidly evolving market, this report is for you!

This report has examined the following points:

Key Takeaways

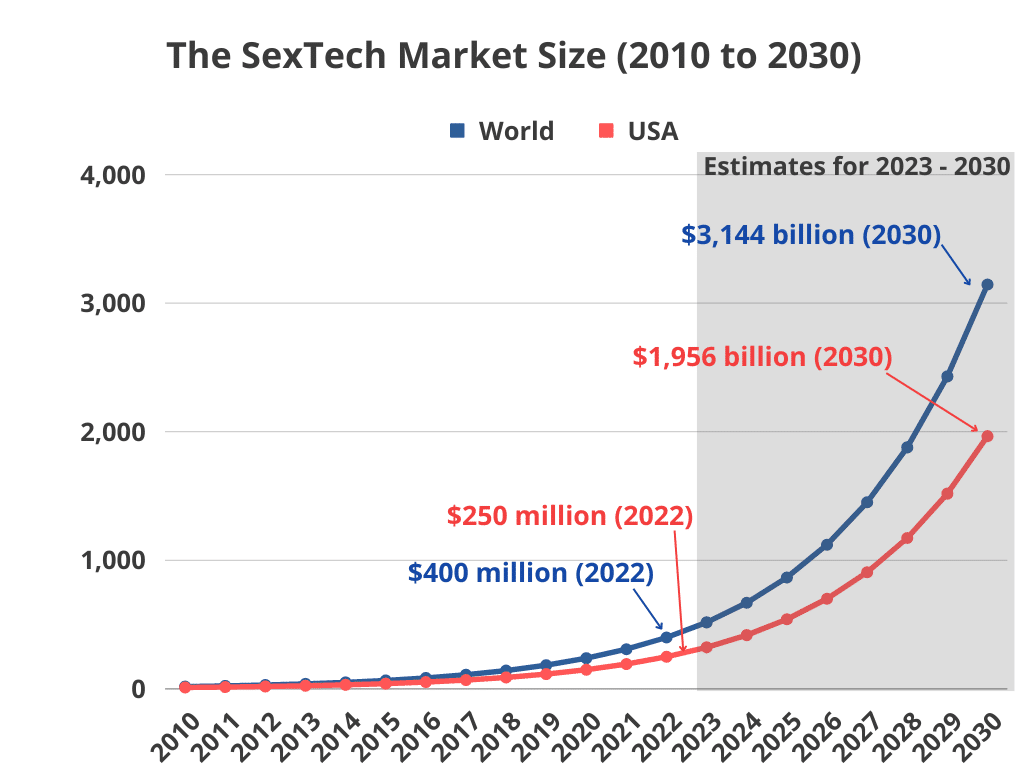

- The Global SexTech Market is valued at $400 million and the US SexTech market is valued at $250 million. Meaning it accounts for more than 50% of the global sex tech industry.

- The sextech market is part of the global sex toy market which is estimated to be 40 billion dollars. The US sex toy market is estimated to be 15.6 billion worth. So sextech is part of markets that have a huge size.

- The sex tech industry is expected to keep growing until 2050 with an average CAGR of 29.4%

- Sex toy accounts for 63% of all products in the sex tech industry.

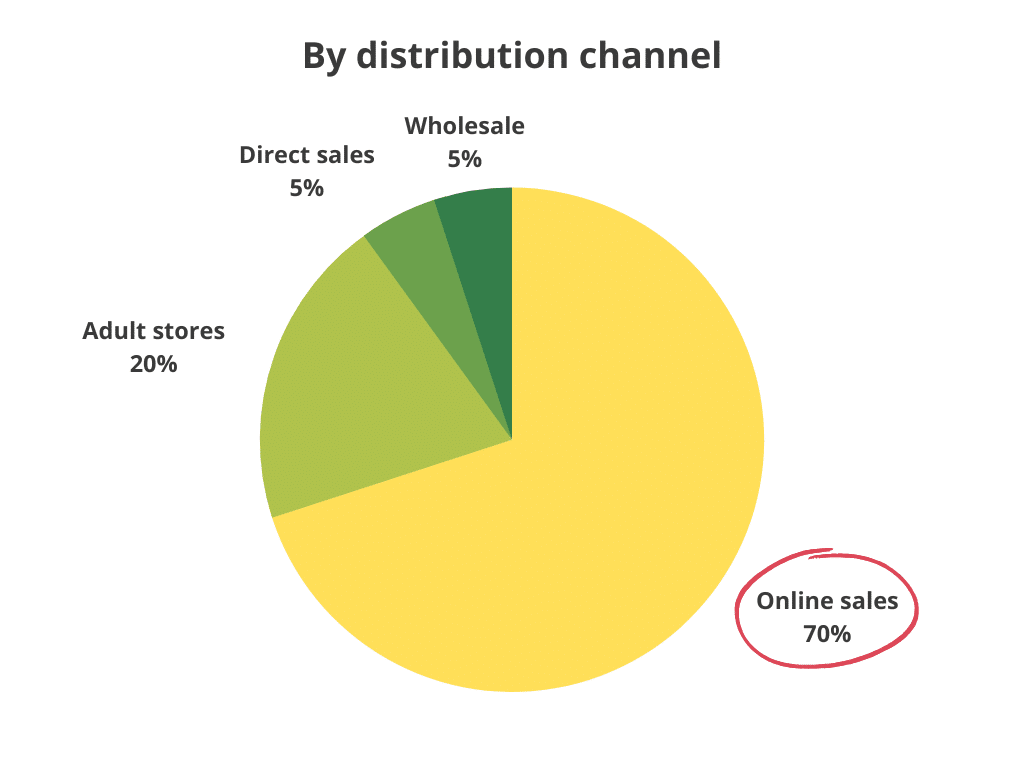

- Online sales account for 70% of the sales of sex tech products.

- 7 out of 10 sex tech companies are bankrupt within the first 5 years.

- The pandemic increased the sales of sex tech products by 180%. Since they have long-range functionalities.

- 2 out of 10 investors are embarrassed over the niche and think about what their surroundings think about them being invested in the niche.

- Teledildonics or internet-connected sex toys is the fastest-growing segment within sextech with a CAGR of 37%.

- Venture capital investment in sex tech companies has also been on the rise, with $174 million invested in the industry in 2022, up from $78 million in 2021 in the US. Since 2016 investors have invested more than 3 billion USD in the sextech industry.

- 65% of consumers of sex tech products are males aged 25-35 years old.

- 73% prefer sex tech products over normal products.

- By distribution channel

Online sales (70%)

Physical stores (20%)

Direct sales (5%)

Wholesale (5%)

Definition: What is sex tech

SexTech refers to the intersection between technology and human sexuality. It encompasses a wide range of products and services, including sex toys, virtual reality experiences, dating apps, and adult content. Essentially, any technology that is used to enhance or explore human sexuality can be considered part of the sex tech industry.

The goal of SexTech is to create new and innovative ways to enhance human sexual experiences, as well as to improve sexual health and education. This can include everything from using virtual reality to create immersive sexual experiences to developing apps that help people track their sexual health and preferences. A few examples of sex tech companies are Handy Male Masturbator, Lioness.io, and many more (we have listed a lot of sex tech companies and startups further down in this report.

The biggest sex tech companies, startups, and scaleups

The sex tech industry is rapidly growing, with numerous companies, startups, and scaleups entering the market to meet the increasing demand for innovative and high-quality sex toys and products. In this section, we will highlight five established companies, scaleups, and startups, and provide a brief explanation of why they are in each category.

Established Companies

Have been in the industry for a longer period and have a well-established customer base, reputation, and brand recognition.

- We-Vibe – We-Vibe is a well-established sex tech company that has been producing high-quality sex toys since 2008. They have a loyal customer base and a reputation for innovation and quality.

- Fleshlight – Fleshlight is another established sex toy manufacturer that has been in business since 1995. They are known for producing high-quality male masturbators that are popular among men of all ages.

- LELO – LELO is a luxury sex toy company that has been in business since 2003. They are known for their high-end vibrators and other products, which are designed for discerning customers who are willing to pay a premium for quality.

- Kiiroo – Kiiroo is a sex tech company that specializes in teledildonics or internet-connected sex toys. They have been in business since 2013 and have established themselves as a leader in this emerging field.

- OhMiBod – OhMiBod is a well-known sex tech company that has been in business since 2006. They are known for their app-controlled vibrators and other innovative products, which have helped to establish them as a leader in the industry.

Scaleups

Companies that have achieved early success and are experiencing rapid growth. They have demonstrated the potential for continued growth and are working to scale their operations and increase their market share. Scaleups are typically focused on building out their infrastructure, hiring more employees, and expanding into new markets.

- Lovense – Lovense is a sex tech scaleup that has seen significant growth in recent years. They specialize in long-distance, app-controlled toys and have gained a following among couples in long-distance relationships.

- MysteryVibe – MysteryVibe is a startup that has seen rapid growth in recent years thanks to its innovative products, including a modular vibrator that can be customized to fit the user’s preferences.

- Satisfyer – Satisfyer is a sex tech scaleup that has seen rapid growth in recent years thanks to its innovative products, which use air-pressure technology to provide a unique sensation.

- Lora DiCarlo – Lora DiCarlo is a startup that has gained attention for its innovative products, including a robotic G-spot stimulator that has been praised for its unique design (OBS: Bankrupt – read more here)

Startups

Companies that are in the early stages of development are working to establish themselves in the market.

- B-Vibe – B-Vibe is a sex tech startup that specializes in anal toys, including app-controlled products that are designed for couples.

- Crave – Crave is a startup that produces high-quality sex toys that are designed to be discreet and stylish, with a focus on innovation and design.

- HUM – HUM is a sex tech startup that produces a range of innovative products, including a sonic-powered vibrator that has been praised for its unique sensation.

- Unbound – Unbound is a startup that produces a range of sex toys and other products designed for women, with a focus on innovation and inclusivity.

- Lioness – Lioness is a startup that produces a smart vibrator that is designed to help women track and understand their sexual health and pleasure.

Other examples of sex tech companies

- Quinn

- MakeLoveNotPorn

- SkiiMoo Tech

- Handy

- Afterglow

- Myhixel

- Raspberry Dream Land

- Coral

- Femira

- Bedbible.com

Funding of sex tech startups

In the last 2 years, European companies within sex tech have raised more than 232 million euros which is 1/3 of what pet tech gets – even though sex tech is more than four times worth. For European companies, it seems like 3 million dollars is the cap for their investment rounds. The US is a bit more invested in sex tech companies. The market in the United States is simply more developed and ahead of its time. Below you can see some different funding rounds for sex tech companies in the USA and Europe:

| Company Name | Country | Funding Round | Year of Funding Round | Funding Amount (USD) |

|---|---|---|---|---|

| Lovense | US | Series A | 2021 | $15 million |

| Kiiroo | Netherlands | Series A | 2020 | $3.6 million |

| Dame Products | US | Series A | 2020 | $10 million |

| LELO | Sweden | Series A | 2019 | $17 million |

| Lora DiCarlo | US | Seed | 2019 | $2 million (initial funding) |

| Emjoy | Spain | Seed | 2021 | $3.3 million |

| Unbound | US | Series A | 2019 | $3.5 million |

| Lioness | US | Seed | 2017 | $1 million |

| OhMiBod | US | Series B | 2017 | $4 million |

| We-Vibe | Canada | Growth Equity | 2016 | $5 million |

| Joyclub | Germany | Seed | 2015 | $1.7 million |

| B-Sensory | France | Seed | 2014 | $300,000 |

| Crave | US | Seed | 2012 | $2.4 million |

| For Hims | US | Series C | 2020 | $100 million |

| ThePillClub | US | Series B | 2020 | $41.9 million |

| HelloCake | US | Seed | 2022 | $3.5 million |

| Dripstick | US | Seed | 2020 | $1.5 million |

| Dipsea | US | Seed | 2019 | $5.5 million |

| Handy | US | Series A | 2019 | $8 million |

| Killing Kittens | UK | Seed | 2019 | $710,000 |

| Kama | US | Seed | 2021 | $4.4 million |

| Mojo | US | Seed | 2021 | $1.3 million |

Market opportunities & Barriers to entry

The sex tech market attracts a lot of new companies and investors every day. This is primarily because “Sex sells”, and the industry is expected to grow with high percentages in the coming years.

When you start a new company there are often market opportunities and barriers to entry. This is something you’ll have to take into consideration primarily before but also while you’re having a business.

Market opportunities

Growing market: The global market for sex tech products and services is projected to reach $400 million in 2022 and keep increasing with a CAGR of 29.4% to 2050.

Increasing acceptance: There is a growing acceptance of sex and sexuality, which has led to an increase in demand for sex tech products and services.

Disruption of traditional industries: The sex tech industry is disrupting traditional industries such as the adult entertainment industry, which is being replaced by more inclusive and diverse forms of content.

Niche markets: There are many niche markets within the sex tech industry, such as products for LGBTQ+ individuals, seniors, and people with disabilities.

Barriers to entry

Legal challenges: Sex tech companies may face legal challenges due to the taboo nature of the industry. This includes issues related to obscenity laws, age restrictions, and content regulation.

Payment processing: Many payment processing companies are hesitant to work with sex tech companies due to the high risk associated with the industry.

Manufacturing and distribution: The manufacturing and distribution of sex tech products can be challenging due to the sensitive nature of the products.

Stigma: There is still a significant stigma associated with the sex tech industry, which can make it difficult to attract investors, customers, and employees.

Competition: The sex tech industry is becoming increasingly competitive, with new companies entering the market every day. This can make it challenging for new entrants to gain a foothold.

Market trends and Sex Tech Predictions (next 30 years)

In recent years, the sex tech industry has experienced significant growth, driven by increasing acceptance and demand for sex-related products and services. This trend is expected to continue in the coming decades as society becomes more open-minded and progressive in its attitudes toward sex.

Here are 10 possible market trends and predictions for sex tech in the next 30 years:

- Virtual Reality and Augmented Reality

Virtual and augmented reality technology will become more sophisticated, creating more realistic and immersive sexual experiences. This could lead to the rise of virtual brothels or sex clubs, allowing users to engage in sexual activities with virtual partners. - Wearable Technology

Wearable technology will continue to evolve, providing users with more personalized and interactive sexual experiences. Smart sex toys will become more common, enabling users to control and customize their experience using their smartphones. - Health and Wellness

As people become more health-conscious, sex tech will focus on promoting sexual wellness and addressing sexual health issues. There will be an increased emphasis on safe sex practices, prevention of STIs, and promoting sexual pleasure as a vital aspect of overall health and well-being. - Diversity and Inclusivity

Sex tech will become more diverse and inclusive, catering to a broader range of sexual orientations, preferences, and needs. This will include products and services specifically designed for the LGBTQ+ community, disabled individuals, and people with unique sexual preferences. - Social Acceptance

Society’s attitudes toward sex and sexuality will continue to evolve, leading to greater acceptance and openness around sexual expression. This will create more opportunities for sex tech companies to expand their products and services, and a larger market for consumers to explore. - Robotics and AI

As robotics and artificial intelligence technologies continue to advance, we may see the development of more advanced sex robots that can interact and engage with users in increasingly lifelike ways. These robots could be programmed to respond to voice commands or even simulate emotional connections with their users. - Telepresence

Telepresence technology, which allows users to experience virtual reality environments as if they were really there, could revolutionize long-distance relationships and virtual sex. This technology could enable users to interact with partners from different parts of the world in ways that are currently impossible. - Biotechnology

Advances in biotechnology, such as gene editing and human augmentation, could have a significant impact on the sex tech industry. It’s possible that we could see the development of new forms of sexual enhancement, such as genetic modifications that increase sexual desire or improve sexual performance. - Regulation and Ethics

As the sex tech industry grows and becomes more mainstream, there will likely be increased scrutiny and regulation around the use of these technologies. Ethical considerations will also become increasingly important, particularly around issues like consent, privacy, and the potential impact of these technologies on human relationships. - Cultural Shifts

Cultural shifts around sexual norms and attitudes could also impact the sex tech industry. As society becomes more accepting of non-traditional sexual orientations and relationships, we can see the development of new products and services that cater to these communities.