![Sexual Wellness Market [Figures, Numbers & Facts]](https://wp.bedbible.com/wp-content/uploads/2023/04/Sexual-Wellness-Market-Size-Industry-Report-1.png)

The sexual wellness market is growing fast and is expected to continue this development in the coming years. The primary reason for this is the fact that the attitudes towards sexuality and sexual health become more open and progressive.

This industry report provides an in-depth analysis of the sexual wellness market, consisting of sections about market size, distribution channels, companies, competition, market shares, trends, opportunities, and barriers to entry. So, if you’re curious about the booming sexual wellness market and want to stay ahead of the game continue down and start reading our key findings.

These are the topics addressed in this report:

- Market size & insights (Global and USA)

- Distribution channel

- Region

- Companies, competition, and market shares

- Sexual Wellness Trends and Opportunities

- Barriers to entry

Key Findings

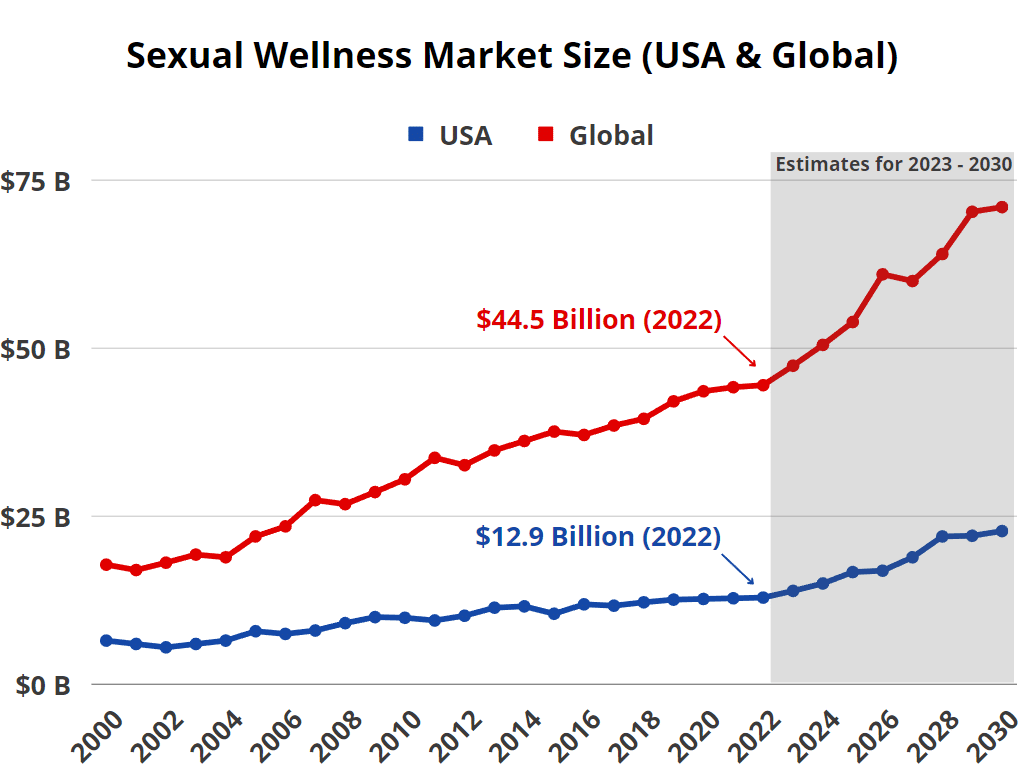

- $44.5 billion is the Global Market Size and $12.9 billion is the US Market Size of the Sexual Wellness Industry.

- Sex toys make up 44% of the overall sexual wellness market, followed by personal lubricants at 24%, condoms at 20%, and other products such as menstrual cups, oral liquids, and sprays comprising the remaining 12%.

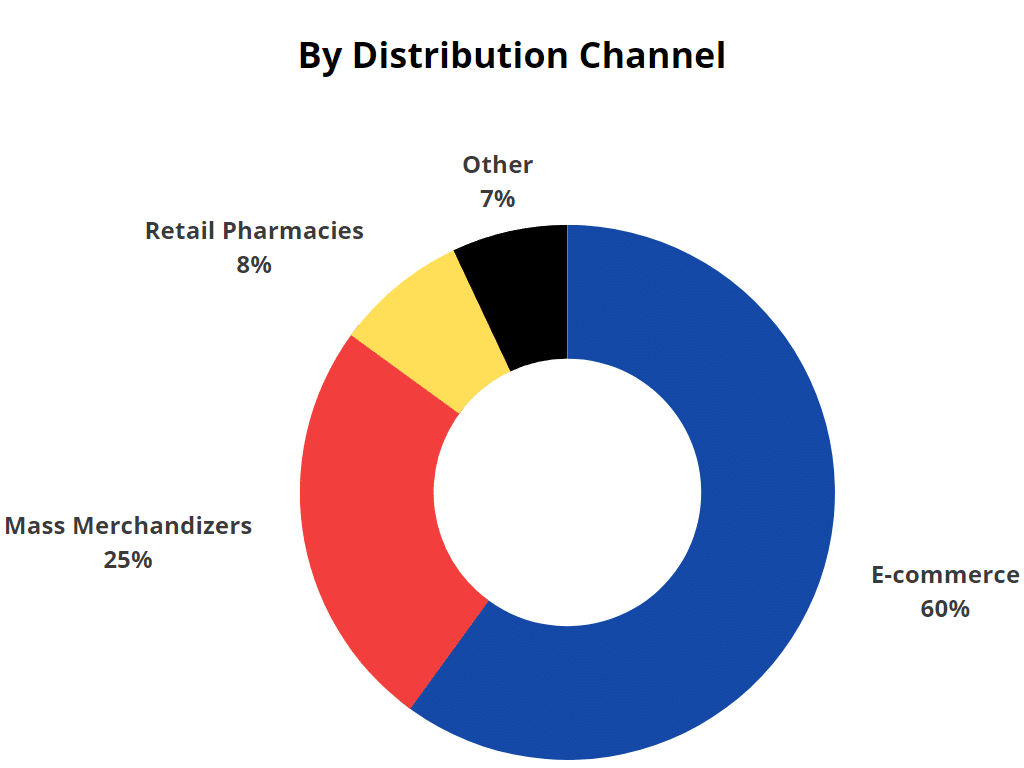

- E-commerce represents 60% of total sales for sexual wellness products and services, while mass merchandisers contribute 30%, and retail pharmacies account for the remaining 10%.

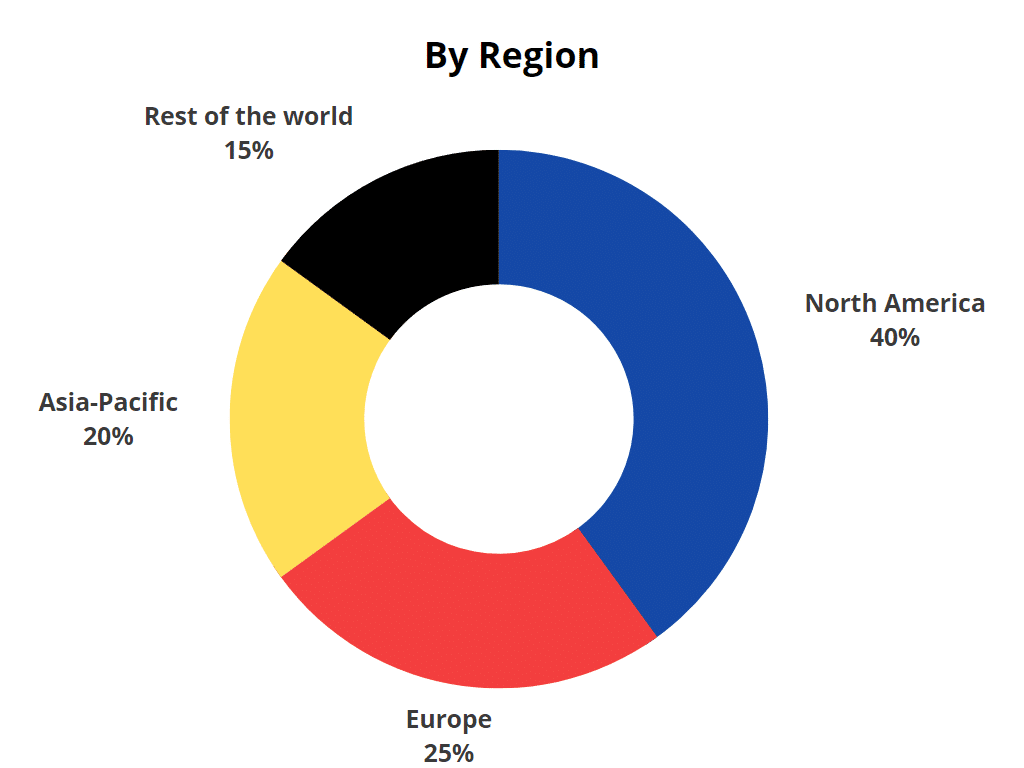

- North America claimed the largest market share at 40%, with Europe trailing at 25% and the Asia-Pacific region at 20%. The remaining 15% was accounted for by the rest of the world.

- Sex tech products are the fastest-growing product type within the sexual wellness industry.

Market size & insights (Global and USA)

Definition of Sexual Wellness: Sexual wellness refers to a broad range of products and services designed to support and enhance sexual health and pleasure. These products/services may include personal lubricants, condoms, sex toys, menstrual cups, and other things that can help promote sexual well-being.

- The Global Market Size of the Sexual Wellness industry is $44.5 billion in 2022 and is expected to grow with an average CAGR of 6.6% by 2030.

- The US Market Size of the Sexual Wellness Industry is $12.9 billion in 2022 and is expected to grow with an average CAGR of 7.8% by 2030.

- Sex toys account for 44% of the total sexual wellness market, Personal Lubricants 24%, Condoms 20%, and the rest 12% such as Menstrual cups, Oral Liquids, Sprays, etc. (Among these categories, sex toys and personal lubricants were the largest and fastest-growing segments).

- The pandemic (COVID-19) resulted in a decrease in the market growth of 1.2% from 2020 to 2021. This is the only decline that the Sexual Wellness Market has ever experienced. (Should be mentioned that COVID-19 after this year accelerated the growth in 2022 by 12%).

- The sexual wellness market has experienced growth partly due to changing demographics, with millennials and Generation Z consumers becoming more open to discussing and prioritizing sexual health and well-being.

- There has been significant growth in products specifically designed for women’s sexual wellness, such as vibrators, kegel exercisers, and menstrual cups. This is due to increasing female empowerment and the destigmatization of female sexuality.

- The market has seen a rise in the availability of sexual wellness education and resources, both online and offline. This includes blogs, podcasts, workshops, and courses that aim to improve sexual health and well-being. Find more statistics on sex education here.

- There has been a growing demand for sexual wellness products made with eco-friendly, body-safe materials, such as silicone, glass, and stainless steel. This trend reflects increasing consumer awareness of environmental and health concerns.

- The market has seen innovations in wearable technology for sexual wellness, such as smart vibrators and devices that track sexual activity and provide feedback to users. This market is also referred to as sex tech. Read our in-depth market report about that here.

Distribution channel

- E-commerce platforms played a significant role in the growth of the sexual wellness market, with a large portion of sales coming from online channels. This was further accelerated by the COVID-19 pandemic, which led to an increase in online shopping.

- E-commerce accounts for 60% of all the sales of sexual wellness products and services.

Mass Merchandizers (e.g. Grocery stores such as 7-Eleven/Walmart) account for 30% of all the sales of sexual wellness products and services.

Retail Pharmacies account for 10% of all the sales of sexual wellness products and services.

Region

- Regional Analysis: North America held the largest market share in the sexual wellness industry (40%), followed by Europe (25%) and the Asia-Pacific region (20%), and lastly the rest of the world (15%).

- The Asia-Pacific market was expected to witness the fastest growth rate in the coming years, primarily driven by increasing awareness and changing attitudes towards sexual wellness in countries like China, India, and Japan.

- The US is expected to keep being the biggest region in the world for the sexual wellness market by 2030. This is primarily due to the more liberal policies. It is expected that the Asia-Pacific region will get to the USA’s level a bit after 2030.

Companies, competition, and market shares

- The market is fragmented with many players accounting for the majority of the market revenue share.

- Some of the leading companies operating in the sexual wellness market include:

Church & Dwight Co. Inc.

Reckitt Benckiser Group plc.

Veru Inc.

Doc Johnson Enterprises

Mayer Laboratories Inc.

Lifestyles Healthcare Pte Ltd.

BioFilm Inc.

LELO

Lovehoney Group.

Trigg Laboratories Inc.

Innovus Pharmaceuticals Inc.

Unbound.

CC Wellness.

WetLubes

Adam & Eve Store

Bijoux Indiscrets - Sexual Wellness outperforms many other niches in terms of CAGR growth:

| Industry | 2016-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2030E |

|---|---|---|---|---|---|

| Sexual Wellness | 5% | 37% | -1.2% | 12% | 6.6% |

| Cycling | 9% | 48% | 11% | 0% | 2.9% |

| PC Gaming Equipment | 8% | 23% | 1% | 7% | 8% |

| Crafts | 2% | 26% | -1% | -2% | 1% |

| Beauty | 7% | -4% | 21% | 3% | 5% |

| Fishing Equipment | 3% | 25% | -2% | -9% | 3% |

Sexual Wellness Trends and Opportunities

- A key factor driving the expansion of the sexual wellness market is the increasing consciousness regarding sexual well-being.

- Millennials and the younger generation are the segments that buy the most sex toys. They prefer purchasing fun products that are tech-driven. See this research article on more sex toy usage and industry statistics.

- Sex tech products are the fastest-growing product type within the sexual wellness industry.

- The sexual wellness market was witnessing increased consumer awareness, demand for high-quality products, and a focus on personalization, customization, and technological innovations in product offerings.

- The shift of self-care products from a luxury to a fundamental need has played a crucial role in introducing sexual wellness items into the market. This is an opportunity and trend we see in the sexual wellness market.

Barriers to entry

Regulations and Compliance: The sexual wellness industry is subject to various regulations, including product safety standards, labeling requirements, and import/export restrictions. New entrants must be aware of these regulations and ensure compliance, which can be time-consuming and costly.

Brand Recognition and Trust: Established brands in the sexual wellness market have built a reputation for providing quality products and have gained the trust of consumers. New entrants may face difficulty in establishing brand recognition and building consumer trust, especially when competing against well-known players.

Distribution Channels: Access to established distribution channels can be challenging for new entrants, as larger companies often have exclusive agreements with retailers and distributors. Developing a network of retailers and distributors or creating an e-commerce platform can be resource-intensive for new players.

Product Development and Innovation: The sexual wellness market is driven by product innovation and customization. New entrants must invest in research and development to create unique, high-quality products that cater to the evolving preferences of consumers.

Advertising and Marketing Restrictions: Advertising and marketing sexual wellness products can be challenging due to regulations and restrictions on the content and placement of ads. New entrants must navigate these restrictions while effectively promoting their products to attract consumers.

Economies of Scale: Larger, established companies in the sexual wellness industry can take advantage of economies of scale, enabling them to produce and distribute products at lower costs. New entrants may struggle to compete on price while maintaining profitability.

Socio-Cultural Barriers: In some regions, cultural and social stigmas related to sexual health and wellness can limit the adoption of sexual wellness products. New entrants must be sensitive to these issues and develop strategies to overcome such barriers.