Bumble, a popular dating app akin to Tinder, is known for its unique feature where users swipe left or right to find potential matches. Until now, comprehensive statistics and facts about Bumble have been limited and difficult to access.

To address this gap, we have conducted the most extensive study to date, delving into various aspects of Bumble. Our research encompasses a wide range of topics, including the number of active users on the app, the company’s valuation, current revenue, profitability, user demographics, and other insightful facts. This study aims to provide a thorough understanding of Bumble’s impact and standing in the online dating landscape.

Here’s what you can find in this statistic:

- Bumble active user stats

- Paying users on Bumble

- Bumble revenue

- Average revenue per user (and per paying user)

- Bumble market share

- Valuation

- Bumble Fun Facts

Key Takeaways

- Bumble has 45.1 million active users Worldwide.

- Bumble has 1.8 million paying users (3.5% of active users).

- Bumble made almost $900 million in 2021.

- The average user on Bumble spends $17.5 a year.

- Paying users on Bumble spend an average of $39 a month.

- Bumble has 14% of the online dating app market.

- Bumble is valued at $8.1 billion and is projected to reach a $10 billion valuation by 2025.

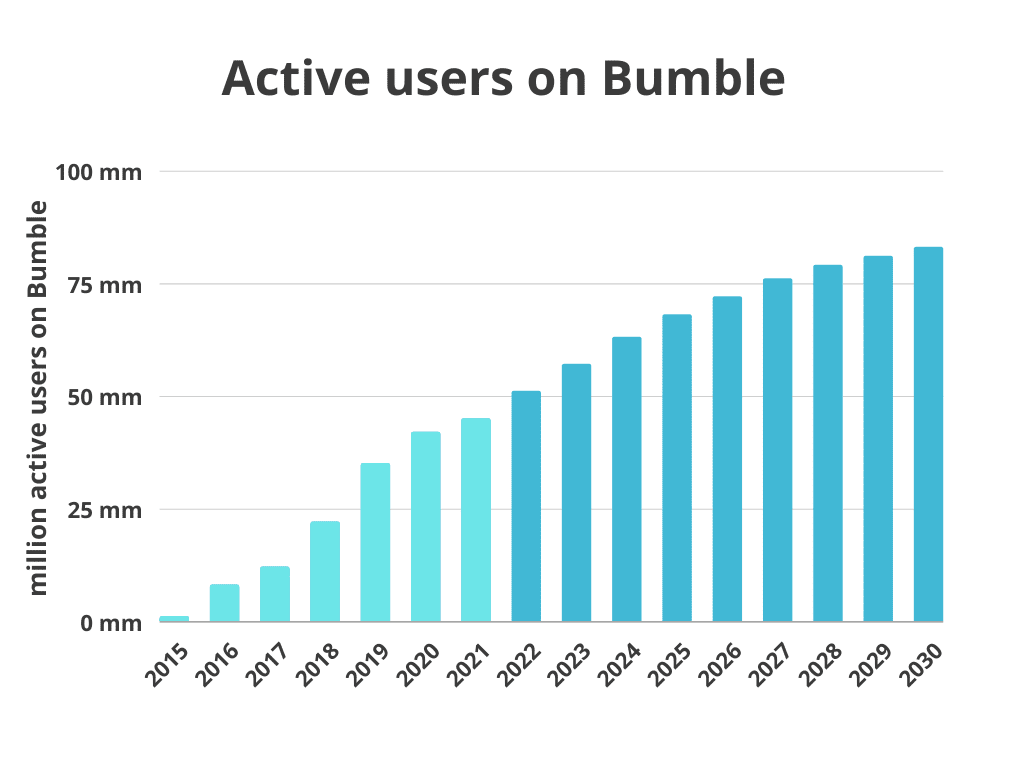

Bumble active user stats

In 2021 Bumble had 45.1 million active users in total, of which just over 3% paid for the app. Bumble is estimated to reach 83 million active users by 2030.

| Year | Active users |

|---|---|

| 2015 | 1 million |

| 2016 | 8 million |

| 2017 | 12 million |

| 2018 | 22 million |

| 2019 | 35 million |

| 2020 | 42 million |

| 2021 | 45 million |

| *2022 | 51 million |

| *2023 | 57 million |

| *2024 | 63 million |

| *2025 | 68 million |

| *2026 | 72 million |

| *2027 | 76 million |

| *2028 | 79 million |

| *2029 | 81 million |

| *2030 | 83 million |

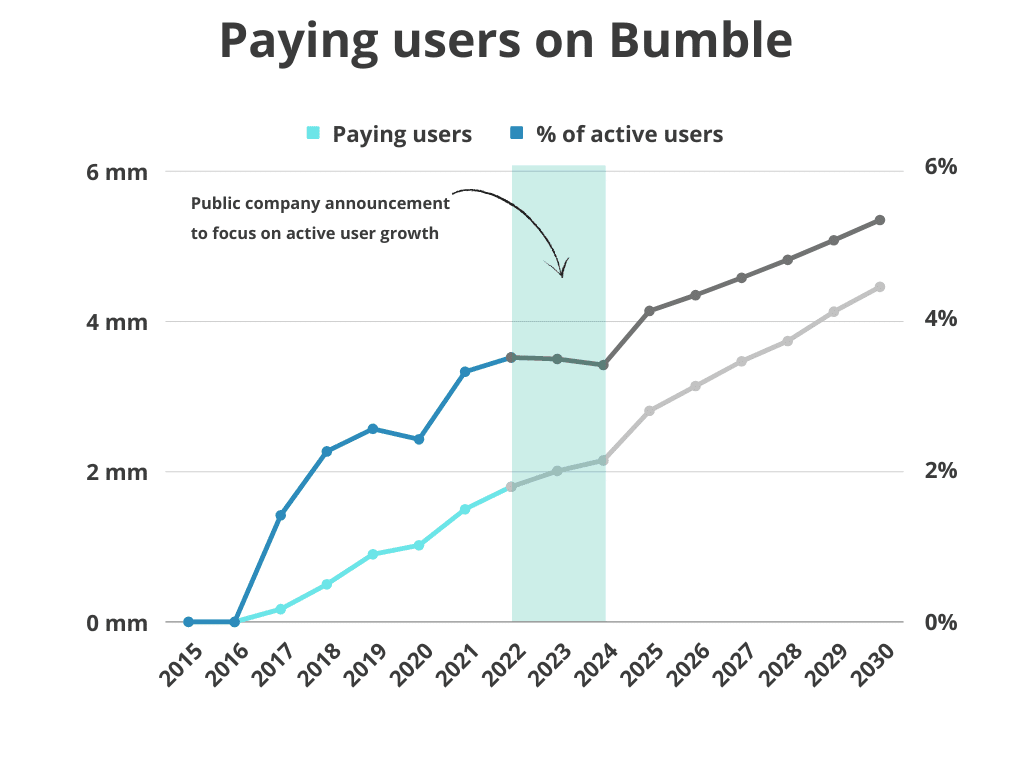

Paying users on Bumble

To judge how well Bumble succeeds in converting users into paid subscribers on their dating app we took a look at the number of paid users. In the first two years of Bumble’s lifetime, they did not take a single subscription fee or have any in-app purchase possibilities. The small amount of revenue generated in this first year came from in-app commercials.

| Year | Paying users | % of active users |

|---|---|---|

| 2015 | 0.00 million | 0.0% |

| 2016 | 0.00 million | 0.0% |

| 2017 | 0.17 million | 1.4% |

| 2018 | 0.50 million | 2.3% |

| 2019 | 0.90 million | 2.6% |

| 2020 | 1.02 million | 2.4% |

| 2021 | 1.50 million | 3.3% |

| 2022 | 1.80 million | 3.5% |

| 2023 | 2.01 million | 3.5% |

| 2024 | 2.15 million | 3.4% |

| 2025 | 2.81 million | 4.1% |

| 2026 | 3.14 million | 4.4% |

| 2027 | 3.47 million | 4.6% |

| 2028 | 3.80 million | 4.8% |

| 2029 | 4.13 million | 5.1% |

| 2030 | 4.46 million | 5.4% |

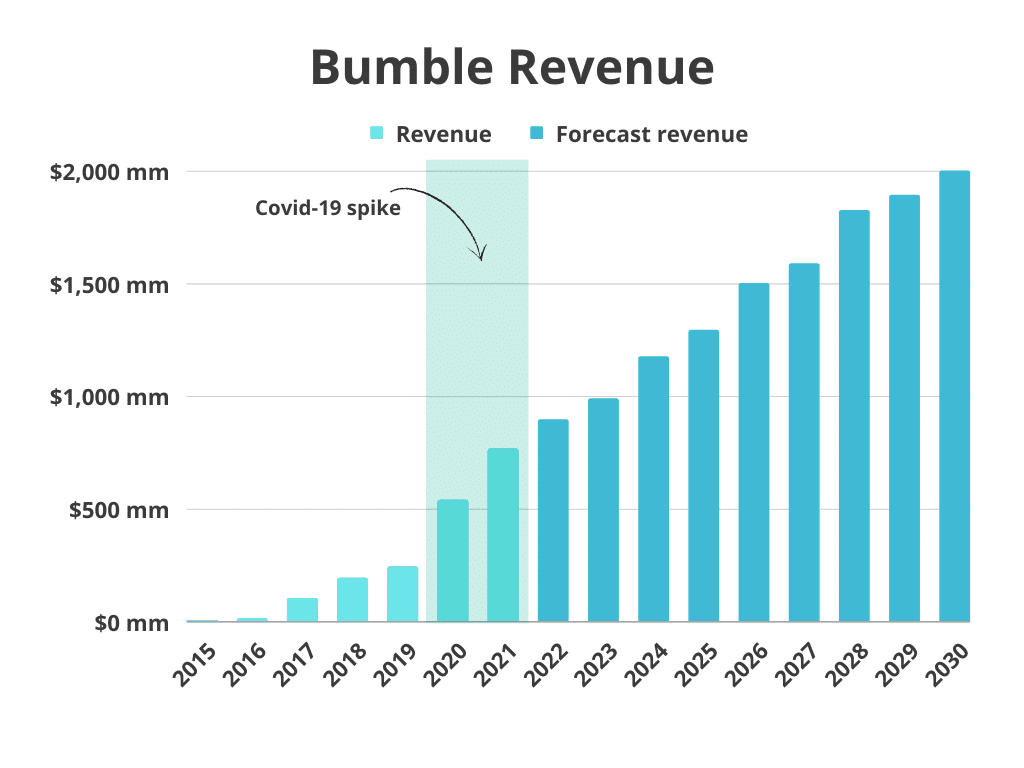

Bumble revenue

Bumbles annual revenue has increased +30% Year-over-Year and is expected to reach almost $1 billion by the end of 2023.

| Year | Revenue ($) |

|---|---|

| 2015 | $1 million |

| 2016 | 10 million |

| 2017 | 100 million |

| 2018 | 190 million |

| 2019 | 240 million |

| 2020 | 337 million |

| 2021 | 765 million |

| 2022 | 893 million |

| 2023 | 986 million |

| 2024 | 1.17 billion |

| 2025 | 1.31 billion |

| 2026 | 1.45 billion |

| 2027 | 1.59 billion |

| 2028 | 1.72 billion |

| 2029 | 1.86 billion |

| 2030 | 1.99 billion |

Average revenue per user (and per paying user)

We calculated the average revenue Bumble made per user and per paying user. Bumble has had a history of having either a strong focus on acquiring more users, and then consequently a focus on turning active users into paying customers. However, hidden in the data is another golden nugget in the Bumble business – they have been masters in earning more and more $$$ per active user.

| Year | Average revenue per paying user | Average revenue per active user |

|---|---|---|

| 2015 | $0 | $1.2 |

| 2016 | $0 | $1.3 |

| 2017 | $588 | $8.3 |

| 2018 | $380 | $8.6 |

| 2019 | $267 | $6.9 |

| 2020 | $330 | $8.0 |

| 2021 | $510 | $17.0 |

| 2022 | $496 | $17.5 |

| 2023 | $490 | $17.2 |

| 2024 | $473 | $18.6 |

| 2025 | $466 | $19.3 |

| 2026 | $461 | $20.1 |

| 2027 | $457 | $20.9 |

| 2028 | $454 | $21.9 |

| 2029 | $451 | $22.9 |

| 2030 | $448 | $24.0 |

Bumble market share

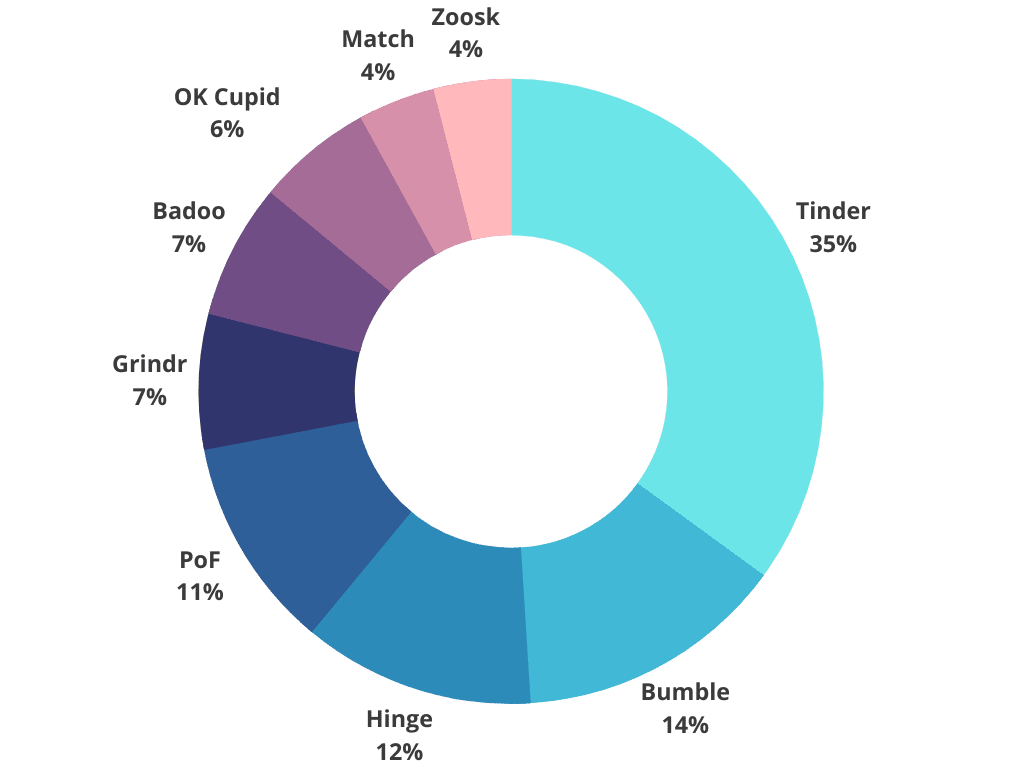

Bumble is half the size of Tinder, which is the world’s most renowned online dating app. The company behind Bumble also owns Badoo, which means they collectively own 21% of the market between the top dating apps.

Valuation

Bumble raised $2.2 billion from investors through their IPO on the 12th of February 2021 at a stock price of $43 valuing the company at 4.2 billion.

The initial stock price quickly shot up to $75.46 per share almost doubling Bumble’s valuation to $8.1 billion.

For a short period, this made Bumble one of the top 1,000 highest-valued companies in the world. However, shortly after trading started Bumbles stock fell to under $40 per share, and a valuation under $4 billion.

Using the same pricing calculations, and other public announcements we were able to precisely estimate Bumble’s valuation each year since its founding as a publicly traded company.

| Year | Valuation ($mm) |

|---|---|

| 2015 | 12.5 million[1] |

| 2016 | 200 million |

| 2017 | 1,000 million[2] |

| 2018 | 1,500 million |

| 2019 | 3,000 million |

| 2020 | 4,200 million[3] |

| 2021 | 8,100 million[4] |

| 2022 | 6,000 million |

| 2023 | 7,500 million |

| 2024 | 9,200 million |

| 2025 | 10,300 million |

Bumble Fun Facts

- Bumble was founded by the VP of Marketing from Tinder, Whitney Wolfe Herd, who sued Tinder for sexual discrimination and got $1 million in settlement.

- The founder of Badoo, Andrey Andreev, invested $10 million in Bumble early on and received receive 79% ownership.

- 46.2% of users on Bumble are female (which is ‘better’ than Tinder which only has 24% women)

- Users on Bumble spend on average 62 minutes a day on the app.

- Bumble only allows women to initiate conversations.

- Some users never date a person from Bumble in real life but instead take advantage of remote sex toys while distance dating. Find our test of the best remote controlled sex toys here.

- Bumble settled a lawsuit in 2020, paying $22.5 million over unfair auto-renewal of subscriptions.